- Amazon has revealed a trio of satellite dishes, as the company prepares to take on SpaceX’s Starlink with its own Project Kuiper internet network.

- The tech giant will offer a standard, ultra-compact, professional version of its antennas, with speeds ranging from around 100 megabits per second up to 1 gigabit per second.

- Amazon said the “standard” version should cost less than $400 each to produce.

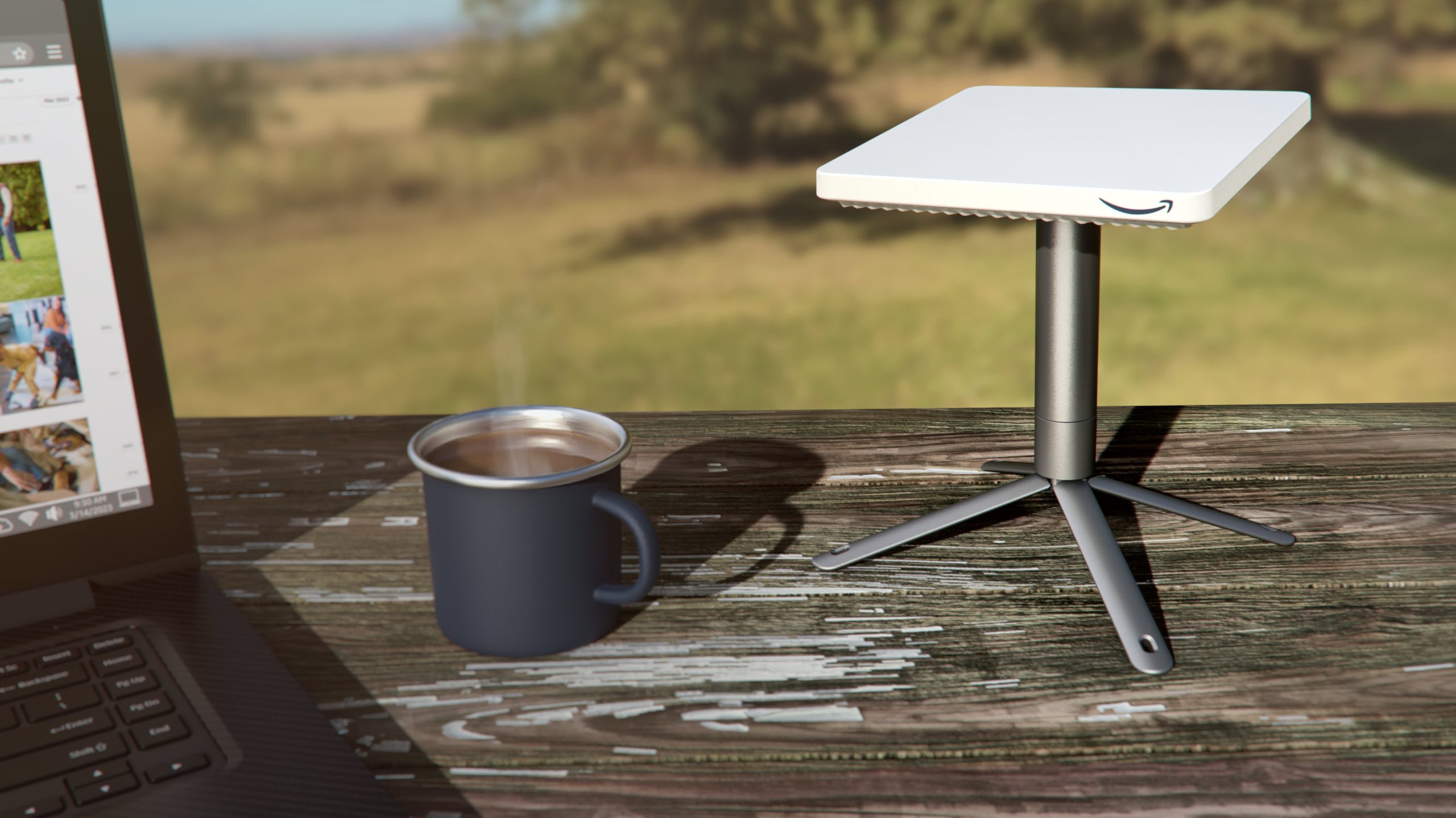

The company’s “standard” customer terminal, the centerpiece of the trio of Project Kuiper satellite dishes at less than 11 square inches and weighing less than five pounds.

Amazonia

WASHINGTON — Amazon revealed a trio of satellite dishes on Tuesday, as the company prepares to take on SpaceX’s Starlink with its own Project Kuiper Internet network.

The tech giant said the “standard” version of the satellite dish, also known as a customer terminal, is expected to cost Amazon less than $400 each to produce.

“Every technology and business decision we’ve made has focused on what will deliver the best experience for different customers around the world, and our lineup of customer terminals reflects those choices,” said Rajeev Badyal, vice president of technology at Amazon. for Project Kuiper. in a statement.

Project Kuiper is Amazon’s plan to build a network of 3,236 satellites in low Earth orbit, to provide high-speed Internet anywhere in the world. The Federal Communications Commission in 2020 cleared Amazon’s system, in which the company said it will “invest more than $10 billion” to build.

The “ultracompact” version of Project Kuiper

Amazonia

The “standard” design measures less than 11 inches square and 1 inch thick and weighs less than 5 pounds. Amazon says the device will offer customers speeds “up to 400 megabits per second (Mbps).”

One “ultracompact” model, which Amazon says is the smallest and most affordable, is a 7-inch square design that weighs about 1 pound and will offer speeds up to 100 Mbps. In addition to residential customers, Amazon plans to offer the antenna to customers government and corporate services such as “land mobility and the Internet of Things”.

Dave Limp, Amazon’s senior vice president of Devices and Services, declined to say how much each ultra-compact antenna costs to make, but told CNBC that they are “materially less” expensive to make than the standard model.

Its larger “pro” model, at 19 inches by 30 inches, represents a high-bandwidth version for the most demanding customers. Amazon says this antenna will be able to “deliver speeds of up to 1 gigabit per second (Gbps)” across space. Badyal told CNBC that there are a variety of corporate and government applications for the pro series, such as “oil rigs in the middle of the ocean” or “vessels that require a lot of bandwidth,” such as naval vessels.

The company’s “Pro” client terminal, the largest of the trio of Project Kuiper satellite dishes at 19 inches by 30 inches.

Amazonia

Amazon has yet to say what the monthly cost of the service will be for Project Kuiper customers.

In showing his first customers his antennas, Limp said he saw them “excited” about the training.

“They are surprised by the prices, surprised by the performance for the size and [the antennas] they’re solid-state, so there are no motors,” Limp told CNBC.

Amazon has said it plans to begin mass production of commercial satellites by the end of this year. Limp told CNBC that once Amazon’s manufacturing facility is fully built, the company plans to produce up to “three to five satellites a day at scale.”

“We’re going to ramp up to that volume,” Limp said.

The company’s first two prototype satellites are expected to launch during the debut mission of the United Launch Alliance’s Vulcan rocket in May.

Badyal told CNBC that Amazon plans to make “minor changes” from the prototypes to the commercial version, as the satellites are “nearly identical” but represent the first time much of the company’s hardware has flown in space.

The company’s prototype Project Kuiper satellites are shipped for launch.

Amazonia

While Amazon has yet to showcase its satellites or reveal many details, Limp noted that the Kuiper spacecraft have a “greater mass” than SpaceX’s first generation of Starlink satellites, with Amazon targeting “goldilocks.” And Amazon expects the performance of its Kuiper satellites to “significantly outpace” Starlink, with expected processing performance of up to 1 terabit per second (Tbps) of traffic. The satellites are expected to have a space life of about seven years before needing to be replaced.

Production satellite launches are expected to begin in the first half of 2024, with initial service expected once the company has a few hundred satellites in orbit, Limp noted.

Last year, Amazon announced the largest corporate rocket deal in industry history and booked 77 launch deals that included options for more as needed from a variety of companies to deploy satellites fast enough to meet regulatory requirements.

Limp said those launches mean Amazon has “enough to lift the vast majority of the constellation” into space.

“I don’t think you’re ever done thinking about pitchability, but we feel pretty good about what we have on the order books,” Limp added. “If new vehicles come online, which are more competitive, we’ll look into it.”

Notably, Amazon has not bought launches from SpaceX, the most active US rocket launcher. Instead, Amazon has tapped a variety of competitors, buying rides largely on rockets that have yet to debut.

“I have no religious problem with not buying capacity from SpaceX, they are a very reliable rocket, but the Falcon 9 was not economically the best rocket for us,” Limp explained.

Asked if Amazon would consider owning a missile system to support its launches, Limp said, “I would never ever say to a question like that,” but that the company seeks acquisitions in areas “where you can have something differentiated and is something in which he is not well served.”

Limp noted that this is a different scenario than something like “Prime Air,” the company’s cargo airline, as it was a situation where the company’s forecast for e-commerce growth was higher than expected. they believed transportation providers like FedEx or UPS or USPS.

“We were just using a lot of the excess capacity… only then, when it stopped being well served, did we look at it,” Limp said. “There has been a shift in being well served for our needs. Right now, I don’t see it from a rocket’s point of view. There are a lot of launches out there.”

#Amazon #shows #satellite #internet #antennas #SpaceXs #Starlink